Crypto Current #99

Welcome to crypto current #99, the final edition for 2025, and rather than another week of news and price moves, we're stepping back to look at the year as a whole. It's been a strange one. Bitcoin hit all-time highs above $126,000, yet most tokens finished the year underwater. Clearer regulatory direction finally arrived in the US, but new layer-1s struggled to find a reason to exist. Memecoins faded while the platforms launching them printed money. The narratives that dominated previous cycles, four-year halving rhythms, alt season rotations, retail-driven pumps, didn't play out the way many market participants expected. Something shifted in 2025. The question is whether it's temporary or structural. We think it's the latter, and this note attempts to lay out our framework for why.

2025: The Year of the Split

Bitcoin touched $126,000 in October before settling in the low-$90s. Currently flat on the year in an environment where risk assets such as S&P500 are +17% Year to date and that headline number masks a more telling story.

Roughly 75% of tokens are negative on the year, with half down more than 40%. The winners fell into three categories: ETF-connected assets that benefited from institutional flows, tokens with direct US regulatory tailwinds (XRP, LINK), and select narratives such as privacy. Everything else, including the majority of Layer 1s, DeFi, Real World Assets, NFT’s and infrastructure got crushed.

What worked

Stablecoins crossed the Rubicon. Transaction volumes hit $46 trillion for the year (roughly $9 trillion adjusted), up 106% year-on-year. More importantly, the regulatory fog lifted. The GENIUS Act passed the Senate 51-23, establishing the first federal framework for stablecoin issuers. Circle completed its IPO. Tether posted over $10 billion in year to date profit. The regulatory risk question that haunted institutional allocators for years finally has an answer.

DeFi found its business model. Hyperliquid processed over $1 trillion in perpetual futures volume with an annualized revenue run-rate exceeding $1.2 billion, operated by a team of fewer than 50 people. Aave crossed $200 million in cumulative protocol revenue. Ethena scaled USDe from $5.4 billion to $8.4 billion in supply over two weeks when market conditions aligned.

M&A validated the infrastructure. Q2 2025 was the largest quarter for crypto M&A on record: 78 deals totalling $8.2 billion. Coinbase acquired Deribit for $2.9 billion. Ripple bought Hidden Road for $1.25 billion. Kraken purchased NinjaTrader for $1.5 billion. Stripe closed Bridge for $1.1 billion. These M&A waves give some indication of what styles of businesses will be valuable going forward too).

Clearer regulatory direction. Beyond stablecoins, the CLARITY Act passed the House, establishing clearer SEC/CFTC jurisdictional boundaries. The SEC's "Project Crypto" initiative signalled a shift from enforcement-first to engagement. Paul Atkins replaced Gary Gensler. The executive order reversing Operation Chokepoint 2.0 reopened banking access. Two of the three concerns institutional investors have cited for years, regulatory hostility and stablecoin risk, are now largely resolved.

What didn't

New L1s struggled for relevance. Despite significant launches (Berachain, Monad, Movement), new layer-1s faced an existential question: why do we need another chain? Canton Coin illustrated the problem clearly. A private blockchain built for Wall Street, technically capable, institutionally-backed, but with no retail distribution or social premium. The token declined despite the product potentially succeeding. Technical capability without distribution or narrative is worth very little.

NFT volume remained depressed. Despite attempts at revival and some gaming/utility use cases gaining traction, NFT trading volumes stayed well below 2021-2022 peaks. The collectibles thesis hasn't found its second act.

The long tail bled out. The number of tokens competing for capital has exploded, with over 17,000 assets now trading on major venues (as tracked by Coingeko), yet the capital base remains largely circular. Tokens without clear revenue models, institutional sponsorship, or regulatory tailwinds struggled to find bids. There was no market-wide alt season where everything melted up together. The retail flow that powered previous cycles slowed dramatically, and what did arrive was absorbed by ETFs and Digital Asset Treasuries rather than filtering down to smaller tokens.

What surprised

October 10 didn't break the market. The largest liquidation event in crypto history, $19 billion unwound in a single day, over $1 trillion in market cap erased. Within weeks, prices stabilized and began recovering. The "leverage ratchet" played out, but the floor held. Institutional infrastructure, regulatory clarity, and stablecoin maturity created a different market structure than previous cycles.

Privacy made a comeback. Zcash rallied 1000%. Railgun processed $200 million in monthly flows. The Tornado Cash sanctions were lifted. After years of regulatory pressure pushing privacy to the margins, the market rediscovered demand for confidential transactions.

Prediction markets went mainstream. Polymarket received CFTC approval. Kalshi raised $1 billion at an $11 billion valuation. Coinbase, Robinhood, and Gemini all announced competing products. What started as a crypto-native experiment is becoming financial infrastructure.

Memecoin infrastructure outperformed memecoins. Pump.fun launched over 13 million tokens by September and generated > $900 million in cumulative revenue. The tokens themselves mostly went to zero. The platform printing them became one of the most profitable businesses in crypto.

Where this leaves us: The three phases of tech value creation

To frame where crypto sits in its maturation cycle, it helps to borrow a framework from traditional tech investing. New technologies typically move through three phases:

Phase 1: Theoretical - Blue-sky: Transformative promise, early infrastructure, limited commercial activity, high speculation. Crypto's 2017-2020 era. ICOs, theoretical use cases.

Phase 2: Adoption and user growth: Network effects take hold, infrastructure scales rapidly, market cap concentrates in the base layer. Crypto's 2020-2024 period. DeFi summer, NFT boom, L1 wars, rollup scaling.

Phase 3: Revenue and Cashflow: Base layer generates meaningful cash flows, revenue per user emerges as a key metric. This is 2025. Hyperliquid's billion-dollar run-rate. Circle's profitable IPO. Coinbase's $1.9 billion quarterly revenue. Stablecoins processing more volume than Visa. The pipes are making money.

Phase 3a: (Application Layer Monetization): Category-defining applications emerge, revenue per employee dramatically exceeds infrastructure, value shifts from pipes to products users touch daily. In the internet era, this was Google, Amazon, and Netflix eclipsing Cisco and the telecom backbones by 10x.

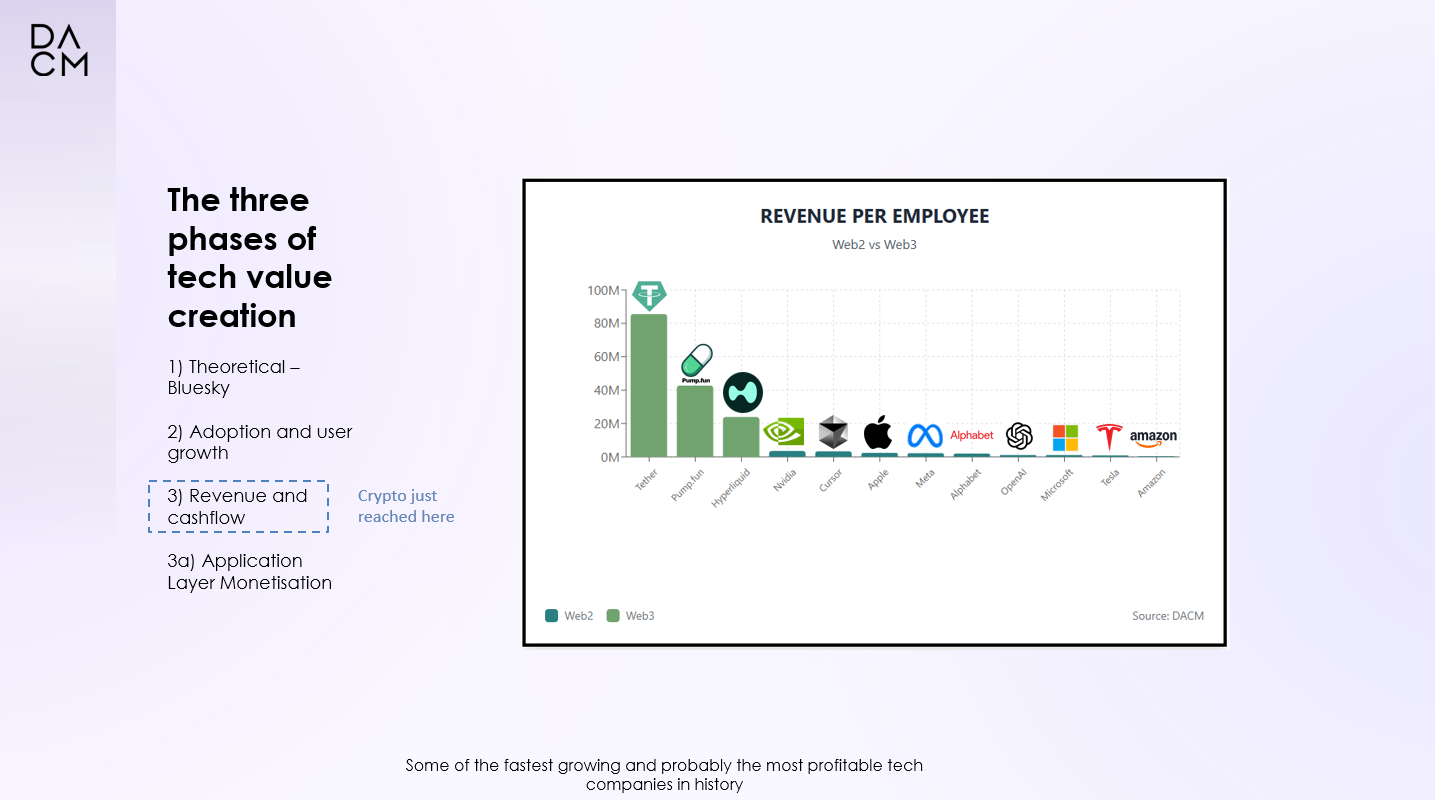

The notable difference in crypto: Phase 3a candidates are emerging faster than historical precedent would suggest. Several protocols now rank among the most profitable businesses globally by revenue per employee (see above), achieving in 1-3 years what internet companies took a decade to build:

Perpetual DEXs (Hyperliquid, Jupiter) processing billions in derivatives volume. Hyperliquid's revenue per employee exceeds $100 million annually.

Lending protocols (Aave, Morpho, Kamino) generating sustainable yield through battle-tested frameworks. Aave manages $33 billion+ in TVL across multiple chains.

Synthetic dollars (Ethena) scaling from concept to $15 billion Total Value Locked (TVL) in 18 months, currently TVL $6.7b.

Consumer rails (Pump.fun, Shuffle) capturing transaction flow at the application layer. Pump.fun generated more fee revenue in 2025 than most listed fintech companies.

Looking ahead

The crypto investor base is changing, and that shift may matter more than any technical development.

Early cycle participants traded on four-year halving cycles, altcoin rotations, and the assumption that new retail waves would always arrive to supply exit liquidity. That playbook worked when crypto was a closed ecosystem with a predictable rhythm.

As capital rotates from crypto-native holders to institutions, family offices, and a new wave of retail with different return expectations, the paradigm changes. The next cohort of investors will likely care less about halving cycles and more about underwriting cash flows and revenue visibility. The sectors that attract their attention will most likely follow the M&A wave as institutions scramble to get positioned first.

Bitcoin's risk as measured by volatility and return as measured by Constant Annual Growth Rate (CAGR) continues to compress toward traditional asset class returns, a natural function of its growing market cap. Capital will increasingly seek out revenue-generating protocols. This will likely form the next phase in crytpo markets, one of value creation, that looks more like traditional investing: identify the businesses generating durable revenue, assess their moats, underwrite their growth.

IMPORTANT NOTICE

This document has been prepared by Digital Asset Capital Management Inc (DACM, and together with its affiliates, related entities and subsidiaries, referred to as ‘we’, ‘our’ or ‘us’). It is for distribution to qualifying professional investors only to the extent permitted by law. It is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or would subject a DACM entity to any registration or licensing requirement within such jurisdiction.

This document is provided solely to recipients who are expressly authorized by DACM to receive it. If you are not so authorized you must immediately delete or destroy it.

DACM is registered as an ‘approved manager’ by the British Virgin Islands Financial Services Commission (FSC). It and any DACM managed fund is not licensed or subject to supervision of FSC or any other regulatory authority outside the British Virgin Islands, such that the requirements considered necessary for the protection of investors that apply to regulated funds in the British Virgin Islands do not apply to DACM or any DACM managed fund. This document has not been reviewed or approved by FSC or any other regulatory authority in any jurisdiction.

General information only. No advice or recommendation. This document does not constitute general advice or personal advice by DACM or any of its affiliated entities or funds in relation to a potential investment in any financial product. It is a general communication and is intended to be educational in nature. It is not an advertisement nor is it a solicitation or an offer to buy or sell any financial instruments, funds, coins or tokens (whether or not subject to securities regulation) or to participate in any particular trading strategy. In Australia, to the extent that this document may contain financial product advice, it is given by DACM Australia Pty Ltd ABN 50 624214 777 (DACM Australia), as corporate authorised representative No. 001293214 of Quay Wholesale Fund Services Pty Ltd AFSL 528526, only to ‘wholesale clients’ as defined under the Corporations Act 2001 (Cth). This document is not authorized for distribution to ‘retail clients’ as defined under the Corporations Act. To the maximum extent permitted by law, neither DACM Australia or Quay, nor their respective directors, employees or agents, accept any liability for any loss arising in relation to this document. Provision of this document is not, and should not be considered as, a recommendation in relation to an investment in any entity or that an investment in any entity is a suitable investment for any specific person. It does not take into account any person’s particular investment objectives, financial situation or needs.

Investment suitability. Recipients should make their own enquiries and evaluations they consider appropriate to determine the suitability of any investment (including regarding their investment objectives, financial situation, and particular needs) and should seek all necessary financial, legal, tax and investment advice. An investment in a DACM managed fund is subject to the fund’s offering memorandum, term sheet or other disclosure document, together with its memorandum and articles of association. Such an investment may be deemed speculative and high risk and should not be regarded as a complete investment program. Digital assets are subject to a range of specific risks associated with their particular features, in addition to the risks of investing in funds or financial assets generally, such as certain regulatory, technology, custody, price, valuation, liquidity, cybersecurity, exchange and market risks. An investment in a DACM fund may present a greater risk to an investor than investment in a regulated fund in the British Virgin Islands or elsewhere. The funds’ investments are subject to substantial market fluctuations and there can be no assurance that appreciation will occur or that material losses will not be realized. The value of investments may fall as well as rise. Past performance is not an indicator of future performance. DACM funds that are open for subscriptions are only available to qualifying professional or accredited investors in selected jurisdictions where an offer of shares is authorized under applicable law and the terms of the offering memorandum. They are designed only for experienced and sophisticated investors who are able to bear the risk of the substantial impairment or loss of an investment in the fund.

Material interests. We and our shareholders, directors, officers and/or employees may have material holdings in the investment funds, projects, coins or tokens referred to and may otherwise be interested in transactions that you effect in those funds. Our actual investment positions may not reflect some or all of the views presented due to a range of possible factors, such as client or fund investment restrictions, liquidity factors, portfolio rebalancing and transaction costs, among others.

No liability. DACM, its affiliated entities and funds, and their respective directors, related parties, representatives and employees, do not accept any liability for the results of any actions taken or not taken on the basis of information in this document, or for any misstatements, errors or omissions negligent or otherwise, to the maximum extent permitted by law. No legal or other commitments or obligations shall arise by reason of the provision of this document or its contents except to the extent required by law.

Incomplete information. This document contains selected information and does not purport to be all-inclusive or contain all relevant information in relation to its subject matter. The information has not been independently verified and is provided on the basis that it will not be relied upon and that the recipient is capable of making its own independent assessment as to the validity and accuracy of the financial assumptions, data, results, calculations and forecasts contained, presented or referred to in the document, and the economic, financial, regulatory, legal, taxation, accounting and other implications of such. No independent third-party audit or review has been obtained or verified as having been undertaken by any third party of the sources, financial assumptions, data, results, calculations and forecasts contained, presented or referred to in this document. DACM does not undertake to update or keep current any information in the document.

Links. This document may provide links to websites and when you click on one of these links, you may be redirected to another provider's website. The inclusion of any link does not imply our endorsement or our adoption of the statements on the linked site or of the operator of the site. Linked sites and their providers are not controlled by us, and we are not responsible for their actions or the contents or the proper operation of any linked site. The links may not remain current or be maintained. We make no guarantees or representations as to, and shall have no liability for, any electronic content delivered by any third party, including, without limitation, the accuracy, subject matter, quality, sequence or timeliness of any electronic content.

Forward statements. This document may contain forward-looking statements, forecasts, historical performance, estimates, projections and opinions (Forward Statements). No representation is made or will be made that any Forward Statements will be achieved or are correct. Actual future results and operations could vary materially from the Forward Statements. Any projections or statements of past performance are provided for general reference purposes and Forward Statements may be based on assumptions relating to the general economy, markets or other factors beyond the control or knowledge of DACM. No representation is given that the assumptions disclosed in this document upon which Forward Statements may be based are reasonable, or that any prices or valuations provided represent DACM’s internal records or that a transaction can or could have been be effected at those prices or values. Any opinions expressed in this document may change without notice and may differ or be contrary to opinions expressed by other DACM representatives or documents. Any statements or data attributed to a third party represent DACM’s interpretation and have not been reviewed by the third party. Facts and circumstances may change and the contents of this report may become outdated or incorrect as a result.

Proprietary information. This document and its contents (including all DACM intellectual property) are propriety to DACM, and must not be reproduced, delivered or disclosed, in whole or in part, to any party other than the authorized recipient to whom this document is addressed, except with the prior written approval of DACM. Images or other data sourced from third parties may contain objects, data or elements that are protected by third-party copyright, trademarks and other intellectual property rights.

© Digital Asset Capital Management Inc. All rights reserved.